Quick, where will your first bank account in Israel be?

One of your first tasks when you step off the plane is opening a bank account so you can start getting sal klitah, the six months of “absorption” money that you’re entitled to when you arrive in Israel.

So that’s why many olim feel rushed into opening their first bank account, and don’t think the process through as much as they should.

Sure, you can always move your account later, but you might not want to once you have an established line of credit, “standing orders” (הוראות קבע/horaot keva – fixed monthly payments), government deposits or debits, not to mention (hopefully) payroll deposits coming in and out of that account every month.

So you do want to put some thought into opening your account, even if it seems like you don’t have a lot of choices. When you look back on your aliyah process in five years’ time, these are some of the mistakes you may end up regretting…

1) You didn’t set aside enough time

I’ve opened bank accounts in Canada where I’ve walked in, plunked down ID on the counter, and walked out 15 minutes later with a bank card. That’s not how it works here.

Set aside a couple of hours, and don’t plan any other bureaucratic tasks (Misrad HaKlitah, Misrad HaPnim, Kupat Cholim) for the same day. (It goes without saying that you should also double-check the hours of the bank location where you’re going.)

Don’t ask me why it takes so long, either. The process seems about the same as it was in Canada – get your information, open the account – except that here, it takes much, much longer. Our bank-person was very busy the whole time chatting with the person beside her, answering phone calls, and… I don’t know what what.

I remember we were in a hurry because we were planning to take the bank account information to Misrad HaKlitah the same day, and they were closing soon. We actually did make it, but just barely and felt very frazzled.

Expect to come away with a whole book’s worth of papers in Hebrew that you have just signed but have absolutely no way to understand. Just ask them to show you the branch (sneef) and account number so you can give it to Misrad HaKlitah.

But DON’T expect to come away either with cheques (checks) or a bank/Visa/ATM card. You can order them when you open your account, but you’ll have to come back another time to pick them up.

If you plan to use online banking (and you should!), ask for a שם משתמש/shem mishtamesh (User ID) or קוד משתמש/kod mishtamesh (User code) and סיסמא/sisma (Password) to log on to your account online. You’ll probably have to come back another time to pick these up.

By the way, Israeli banks are generally “friendlier” than North American banks in that they offer air conditioning, water coolers and bathrooms, as well as comfy chairs in the waiting area to make your stay there more comfortable.

2) You didn’t negotiate

This is Israel. Everything is negotiable. If you have a job already, this makes you a more desirable customer.

If there is any kind of future business potential from you - like if you're thinking of starting a small business or considering a mortgage - let them know that you're shopping around. Ask them what kind of deal they can offer you. Look for lower fees, but only for things you'll actually use.

Where I come from, in Canada, the teller at the bank who opens your account doesn't have much power. They explain the rates and get you to sign on the line. Here in Israel, they have a lot more leeway, so try to make a good impression. If you "click" with someone, they could be your in at that bank from now on.

Finally, smaller banks (like not the big chains) like Yahav and Otzar HaChayal are often more competitive and more interested in your business. These used to be credit unions limited to certain professions and groups, but are now open to every Israeli.

And by the way, don’t be afraid to go to a bank that’s a little farther away from your own neighbourhood if it comes highly recommended. That’s because of the next point, #3, which says that you should spend as little time as possible in your actual bank branch.

3) You paid your bills (or did other transactions) at the bank

If you’re inside your bank branch, you’re paying too much. Period. Teller fees can be five times higher than bank machine (ATM) fees, and believe me, they will charge you for absolutely everything. I read on another blog post about a fee for depositing too much money.

Here are a few ways to cut down your F2F (face to face) time at the bank and save on fees in general:

- Use online banking to check account balances and transaction history wherever possible.

- Use ATMs for routine banking like deposits and withdrawals. Use only machines that are in the same network as your own bank!

- It may be preferable to use your credit card to make payments because you are only billed once a month.

- Some olim have had success looking into “non-bank” credit cards, which are sometimes more flexible and offer lower fees. Your mileage may vary; I have no experience with these.

(If you’re in Israel and have more tips for new olim, I’d love to hear them!)

The best say to save is to keep a vigilant eye on all your bank accounts, lines of credit, etc (online). Watch for unusual or suspicious charges and get an explanation for them right away.

I’ve heard nightmare stories about being charged month after month for services they never received; you may not get your money back if enough time has passed and you’ve allowed the charges to go through.

3) You ordered the wrong kind of checks/cheques

Don’t leave this to chance!

In Israel, it’s perfectly legal to pass on a cheque to someone else as payment. Your bank account in essence becomes a source of legal tender until some stranger is cashing a cheque you wrote to your landlord a year ago. I’ve been told on good authority that the date of the cheque is also irrelevant to these strangers, who will get you in trouble if your cheque doesn’t clear 2 months before the date written on it.

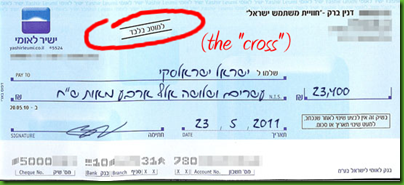

To prevent these and other problems, make sure you only order “crossed” cheques. These have a small diagonal line near the top and the words למוטב בלבד/lamutav bilvad, which means, “only to the payee.”

You’ll pay a little more to order these cheques, but not much (5-10nis?), and it’s worth it. Ask for cheques (it’s the same word – cheque – in Hebrew) עם קרוס/im kros, which means, “with a cross.” Don’t worry, it doesn’t mean what the Christians think it does!

5) You went to a bank (and not to the post office)

Two words: בנק הדואר/Bank Ha-Doar, the Israeli Postal Bank.

Having grown up reading a ton of British kids’ books, I was very familiar with the concept of taking money down to the post office, and here’s it’s totally for real – and it may be your best, most frugal banking option.

The post office isn’t the fanciest bank, and they might not have branches on every street corner (especially since some postal branches seem to be closing up shop), but in terms of handling the basics, they will do it with far less by way of service charges.

- Postal Bank Plus: You can buy stamps and mail parcels while you’re there!

- Postal Bank Minus: Everybody ELSE in your city can buy stamps and mail parcels while you’re there, waiting in line.

Even if you don’t have an account, you can still pay bills at the post office, as well as perform other financial transactions, like receive Western Union money transfers. This is a biggie for us, since our Canadian bank accounts offer an instant Western Union option that has been a good emergency conduit for cash in a pinch.

One final mistake to avoid

Many olim actually say the biggest mistake they've made in banking here in Israel is not realizing how "minus" (pronounced "meee-nus", and it means "overdraft") actually works.

You might not even know that your bank has given you an overdraft. Probably because they don’t tell you - but they might be charging you for it nevertheless!

- When you open your account, you are usually given a מסגרת/"misgeret" (frame) for how much overdraft you're allowed. They might not tell you; find out what this amount is.

- Nobody will call and tell you your account is going into minus. Check online often!

- If you go over your misgeret, or violate other banking rules, you will be מוגבל/"mugbal" (restricted).

The best advice is probably: don’t expect anything to be as easy as where you came from. If it turns out to actually be easy, well, just let it be another one of those pleasant surprises Israel does have in store for all of us from time to time!

I’d love to hear your tips about banking in Israel – leave them in the comments section below!

I've been working as a banker for the last 6 years, serving primarily Anglos - most of them Olim - in Israel. I am terribly sorry, but your article is full of mistakes... I do not know what bank you walked into (and obviously ran out of), but a lot of the stuff you write is simply not true, f.e. checks with a "cross" (למוטב בלבד) cost more...

ReplyDeleteHi! I am always happy to be corrected if I'm wrong about something. But honestly, our bank did charge us extra for the cheques with cross, and I was prepared for that because our ulpan teacher, who was born her and has been banking here for probably more than 40 years, told us it would cost more to buy the cheques that way.

DeleteIf you spotted other errors, I would love to hear about it. PLEASE. You'd be helping out lots of people.

Thanks for stopping by! Tzivia

"Use only machines that are in the same network as your own bank!"

ReplyDeleteIt's simpler than that, with a couple of caveats.

There is only one network of ATMs and they're all attached to it. You can withdraw money at any of them.

Typically, only your own bank's machines will give you the full range of services (whatever their full range is - it may vary). However, there are some banks which share computer systems and in those cases, ATMs of another bank on the same system may give you some more features (like checking your balance) than non-related ATMs, but probably not all of them.

There is normally no fee specifically for ATM use because it's included in the transaction fee for non-teller transactions. It doesn't matter if the ATM is at your bank or another. The exceptions are private ATMs and bank ATMs which are more than a certain distance from a branch - and these machines show a clear notice during the transaction of the extra fee - in the 5-6.5 shekel range at the moment, I think - which will be charged.

There is another thing to be aware of, in general. If one is comparing banks (and not expecting to be able to get discounts on the standard fees) one can compare the fees because the fee schedule is the same for all banks. If you have an idea of the types and quantities of fees you will incur you can work out how much each bank will charge in total. This is way better than in the old days where it was hard to know what you would be charged for because each bank's definitions/parameters were different.

Thank you so much for helping clarify!

Deletewe've been happy Bank Yahav customers for over 5 years. as long as you (or your spouse) is an employee of an Israeli company and you deposit you're monthly salary in the account then pretty much all the standard bank charges are waived. it's called maslul sechirim.

ReplyDeleteThis is very good to know. In a business seminar I was in, the guy in charge specifically recommended Bank Yahav and Otzar HeChayil because they are small banks that are now very well connected but continue to offer small-bank "perks."

DeleteThanks for sharing this valuable tip!